In the advent of volatile global conditions and stricter crisis management, the drive toward compliance is greater than ever. One such area stems from IPO filings required by the SEC.

In our report, Under the Microscope: An Analysis and Report of SEC Comment-Letter Trends Among Middle-Market and Pre-IPO Life Sciences Companies, we looked at S-1, 10-K, 10-Q, and 20-F filings made by life sciences companies during a 12-month review period from May 1, 2018, to April 30, 2019. Comments were analyzed by frequency to identify the topics that fell under repeated SEC scrutiny.

Comments related to SEC reporting tend to be more administrative and formulaic, but because of the sheer volume of such comments, companies could significantly reduce filing delays by understanding the nature of scrutiny surrounding these comments and taking the appropriate steps to comply.

While comments related to R&D continued to remain significant, they saw a slight decline compared with our report from 2017 and 2018. R&D comments typically relate to clinical trials and studies, US Food and Drug Administration (FDA) filings and communication, product pipeline, products and services, and other highly firm-specific information.

Meanwhile, there was an increase in focus on comments related to process compliance, which constitutes the largest category of SEC comments in 2018 and 2019. Other recurring comments include those related to emerging growth companies, controls and procedures, revenue recognition, and material contracts.

Overall Findings

Comment Categories

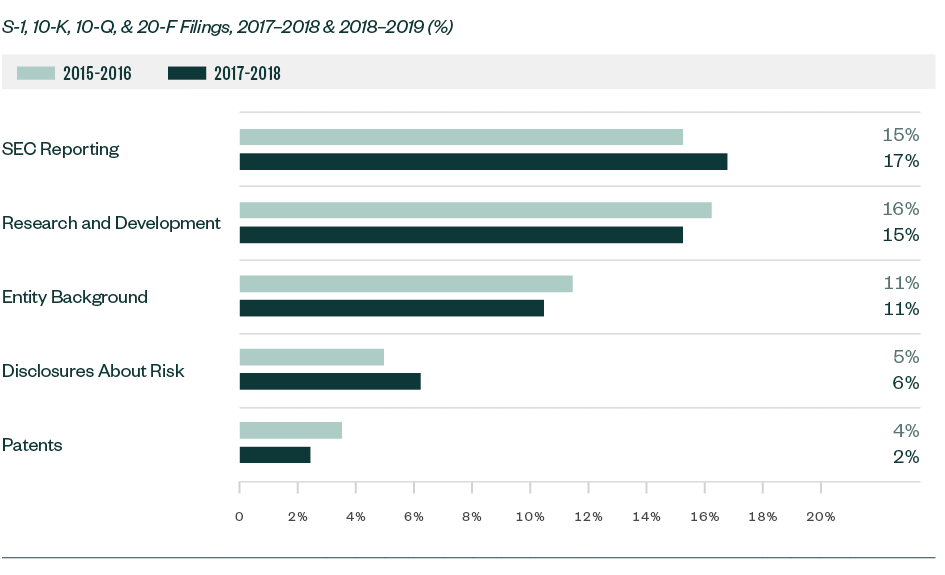

There were 1,236 SEC comments in the S-1, 10-K, 10-Q, and 20-F filings made by life science companies that were reviewed in the report for 2018 and 2019. These were largely spread across several key categories—comments related to SEC Reporting, or process compliance, were the most prominent garnering a 16.7% share.

R&D was the next major category with a share of 15.3%. The majority of those comments were directed toward companies’ clinical trials and studies, similar to the SEC comments in 2017 and 2018. This was followed by comments requiring disclosure on entity-background, management’s discussion and analysis (MD&A), the actual offering, as well as any current or anticipated risks related to the registrant’s business.

Information around licensing agreements, shareholders’ equity, underlying patents, and proxy disclosures on directors and officers collectively constituted another significant chunk of SEC scrutiny, followed by varied comments targeting firm-specific accounting and regulatory features.

The following infographic depicts a breakdown of the 1,236 total comments analyzed, according to category and frequency.

Overview of SEC Comment Categories

Significant Shifts

A number of topics saw a slight-to-significant shift in focus compared with 2017 and 2018; the positive or negative variance was measured in ratio to the total number of comments. This included categories such as SEC Reporting (process compliance), risk-based disclosures, patents, entity-related information, and R&D.

Significant Shifts in SEC Focus for Overall Filings—By Ratio of Comments

However, these shifts were relatively small in comparison to those seen in the 2017 and 2018 report, which highlights that the nature and composition of comments over the past two years remained fairly intact.

Filing Type

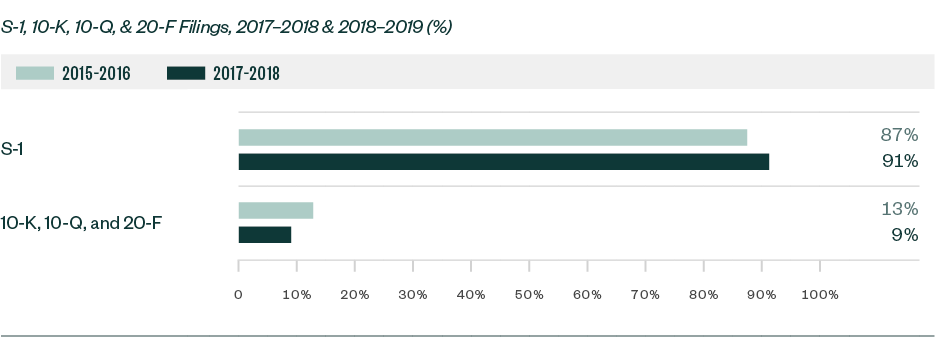

Similar to 2017 and 2018, S-1 filings continued to lead in relation to SEC scrutiny. Of the total 1,236 comments analyzed in this study, 1,126 comments—roughly 91%—arose from S-1 filings, which was up from 87% in 2017 and 2018.

The remaining 9% were spread out evenly among 10-K, 10-Q, and 20-F filings.

Significant Shifts in SEO Focus for Overall Filings—By Ratio of Comments

In terms of categorization, the nature of comments continued to vary between pre- and post-IPO companies. The following areas remained dominant for S-1 registrants:

- Process compliance

- R&D

- Entity background

- Risk disclosure

- Details pertaining to the actual IPO

On the other hand, there was a shift in focus areas for 10-K, 10-Q, and 20-F filers. The following areas constituted more than 50%, or 110 comments, for these three filings:

- MD&A—ranging from critical accounting policies to operational results

- Revenue recognition

- Process compliance

Market Capitalization Range

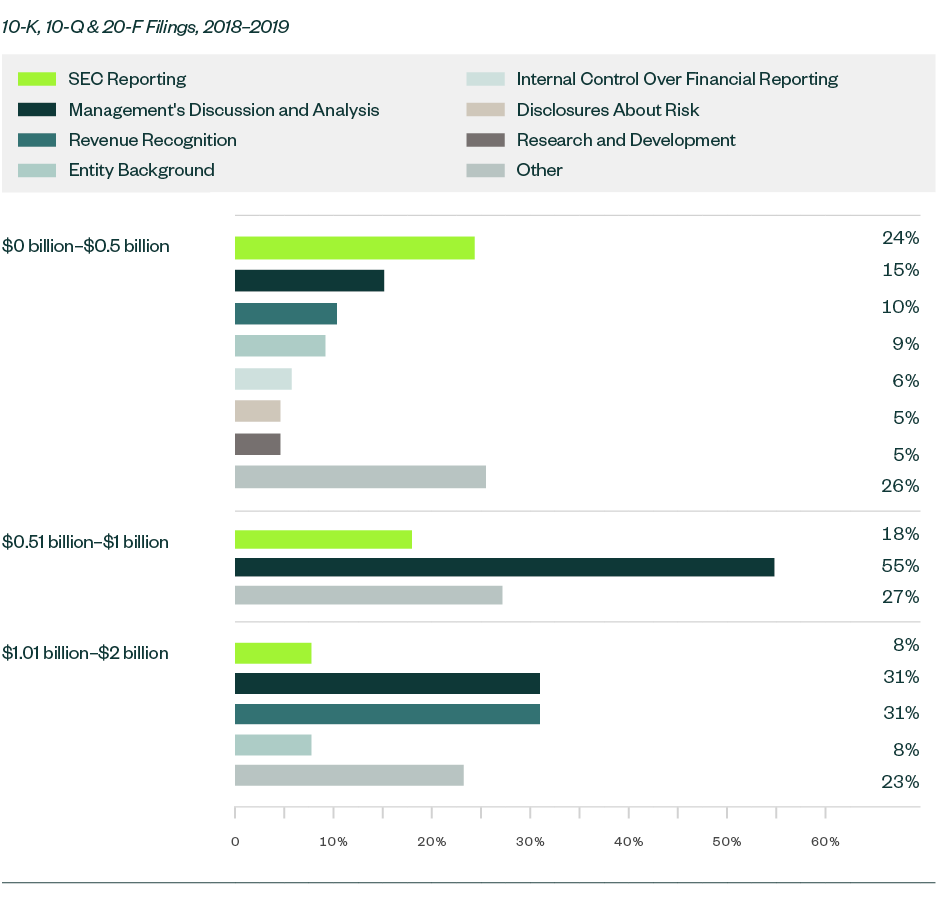

Trends in Comment Categories—By Market Capitalization Range

Over 78% of the SEC’s comments were centered on companies with market capitalization up to $500 million. Consequently, 10% were directed toward those between $501 million to $1 billion, and 12% pertained to those greater than $1 billion but less than $2 billion.

Results by Subindustry

SEC Comments—By Subindustry

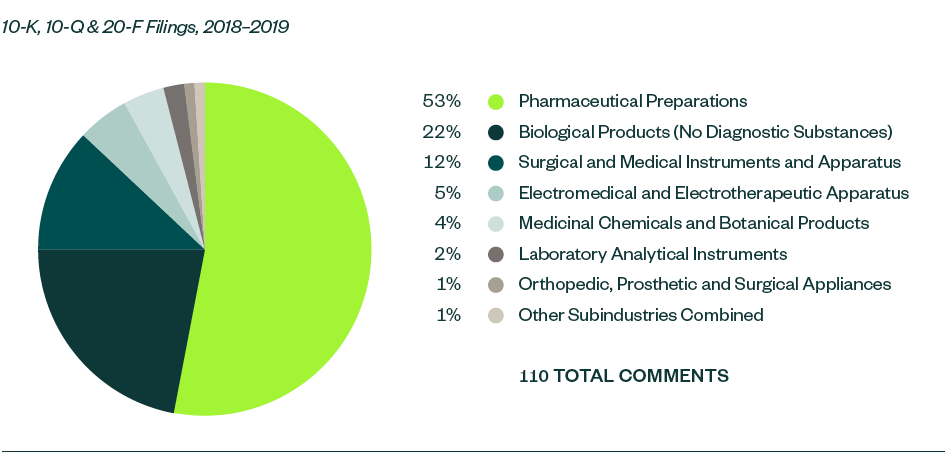

Of all the subindustries analyzed in this study, pharmaceutical preparations continued to gain much of the SEC’s focus.

Biological products was the next most significant subindustry with a share of 22%, followed by surgical and medical instruments and apparatus at 12%. As a subindustry, biological products increased substantially, up 7.2% from the previous study with the total number of comments increasing by 32%.

The breakdown of other subindustries was relatively small—below 5%. Meanwhile, medicinal chemicals and botanical products, which didn’t attract any relevant comments in the previous study, had 54 SEC comments in 2018 and 2019.

Additional Content

The SEC considers both macro dynamics and business-specific value chains in the nature of their review.

SEC comments on process compliance generally were applicable for the entire life sciences sector, but other comments varied among subindustries. For example, scrutiny in R&D remained more significant for pharmaceutical preparations and biological products, while entity-related disclosures were more of a focus for laboratory analytical instruments.

We’re Here to Help

For more information on SEC comments, read our full guide, which covers these topics in greater detail, or contact your Moss Adams professional for insight on how to relate this information to your business.